|

|||||||||

|

|

|||||||||

Accounting |

|||||||||

Today

is

|

|

PACE Accounting Here we are back to the accountants and bookkeeper issues. This keeps coming up because having an integrated general ledger is such a big feature of PACE, and is the poorest understood. I've seen all kinds of work-arounds, procedures, chart of accounts setup, endless manual gl adjustments etc., some were good and some weren't as people tried desperately to make the accounting work. The reason for all this haphazardness was/is due to a lack of training. I estimate that 95% (Greater Vancouver area) do not use the accounting system in PACE. Of the shops that I have seen, not one has used the accounting system completely (eg: prepaid expenses, amortizing, accruing liabilities etc) nor properly, prior to investing in my training program. The majority of shops are duplicating data entry into a Windows-based accounting software, which defeats the purpose of having an integrated software package like PACE. It is a shame actually, because it is so easy to do -- with the exception of finding errors in parts suppliers accounts. Without exaggeration, in addition to day-to-day entries, it takes about a half hour per month to make the 'extra' entries (amortization etc.) and about an hour to make adjusting entries at the end of the month. If there was one thing that PACE (the company) did poorly, it was the training model. The typical new sale consisted of software and hardware delivered and a couple days of training (seminar style). After that there was only phone support (which answered questions but could not elaborate on procedures) and additional paid support. This training model was singularly responsible for the poor acceptance of the PACE accounting system, in my humble opinion. Here are just a few items to check to see if you are using the system properly:

First off, I would like to apologize to everyone for having taken so long to post these instructions. I originally took the tact of investigating every aspect of how implementing the HST would impact the typical shop. I put in a lot of work corresponding to authorities and "experts" and had to delay putting up this page until I attended one of the government sponsored seminars in June. The end result was more than a few conflicting opinions including those at the government seminars. Recently I decided to abandon this great big essay and just concentrate on showing people how to make the changes in Pace. Therefore I will leave it to you to consult with your accountant for the technicalities and legalities of what to charge whom, for what, and when. You are advised to read the "Terms Of Use" page of this website. Essentially, I am offering this information without any guarantee or promises - it's free after all. Here is what I discovered from doing many experiments:

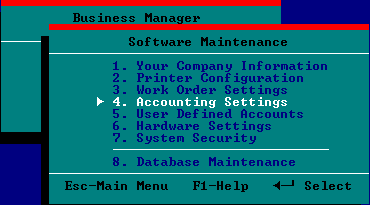

You will need exclusive mode if you are on a network Navigate to Software Maintenance | Select Accounting Settings

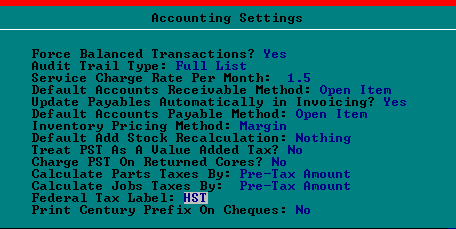

1. How to change the label on the invoices from "GST" to HST" Change the field "Federal Tax Label"

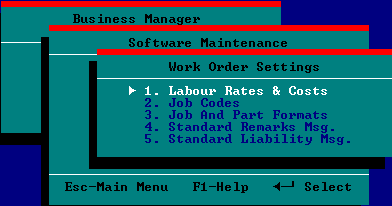

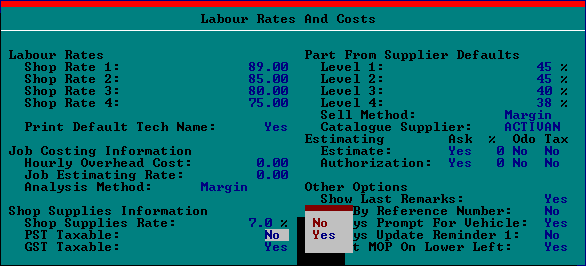

Navigate to Work Order Settings | Select Labour Rates & Costs

2. Remove PST from Shop Supplies Change field "PST Taxable"

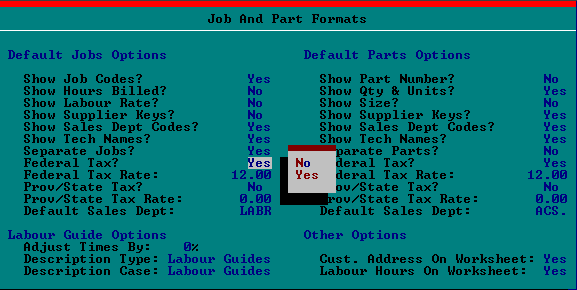

Navigate to Work Order Settings | Select Job And Part Formats 3. Set the new rates, turn off PST Note: Make sure you do both sides ( "Jobs" on the left and "Parts" on the right ) Change the following fields with values according to your province:

You're done with settings

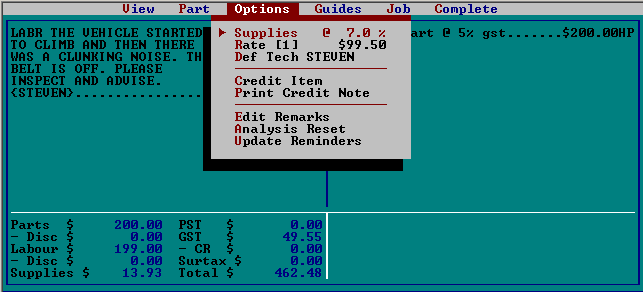

Now you need to update every work order in Work In Progress. This is the easiest way I found. Just press [Enter] on "Supplies", no need to change anything.

You're done! |

|

|||||

|

Home Page |

Welcome |

Payments |

About Me |

Introduction to Pace |

Pace History |

The Concept |

Tire Fee |

Myths-Busted |

Accounting |

Printing |

Networking |

SQLs |

Pace Cheque |

Marketing |

Business Intelligence |

About Red Eye Computers |

Contact Us |

Terms of Use |

Privacy Policy |

Site Map | Site Admin

|

|

|||||