|

|||||||||

|

|

|||||||||

The Concept |

|||||||||

Today

is

|

|

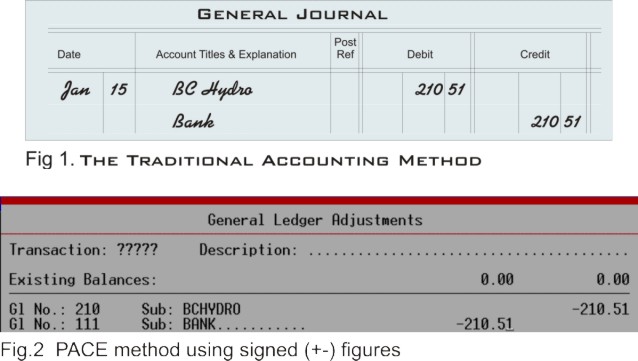

The Concept Background The concept of the PACE system is to provide the business owner with real-time financial information. With PACE the owner has the means to analyse sales data by: year, month, week, day or individual invoices. In addition, all expenses, assets (and amortization), prepaid expense amounts, accrued liabilities, long-term and short-term liabilities can be tracked on a monthly basis to provide a true monthly income and expense statement as well as a balance sheet. The model for developing the program was based on a shop owner working the front counter. This is evidenced by the ease of creating and updating work orders, and the revenue information available from the work order screen's menu. This is the nicest part of the program so obviously a lot of research and development was done to make it just right. Presuming most shop owners are not familiar with bookkeeping, a feature was added that allowed the user to 'force' an account to reconcile by supplying various "Credit Adjustment" and "Debit Adjustment" accounts. Professional accountants call this "plugging" and is akin to sweeping dirt under the carpet. This works great for the busy owner on the front counter trying to get through the day, but it is a source of frustration for the accountant who has to deal with it later. The Problems The single biggest problem the program has encountered is the reluctance of professional accountants and bookkeepers to accept it. This reluctance is due to three aspects:

|

|

|||||

|

Home Page |

Welcome |

Payments |

About Me |

Introduction to Pace |

Pace History |

The Concept |

Tire Fee |

Myths-Busted |

Accounting |

Printing |

Networking |

SQLs |

Pace Cheque |

Marketing |

Business Intelligence |

About Red Eye Computers |

Contact Us |

Terms of Use |

Privacy Policy |

Site Map | Site Admin

|

|

|||||